Dear friends,

It’s been a whirlwind month for us. In just about 30 days, I got married (waves to Chip!), finished my 68th trip around the big ball o’ fire in the sky, bade farewell to my 40th group of seniors (just a heads up, world. They’re coming for you!), visited with the managers from FPA (really, if you put Mr. Scruggs in a cardigan he’d totally rock the Mr. Rogers’ look), watched the Dow hit 40,000 and visited my brothers and sisters in Pittsburgh for the first time in two years.

There’s a certain vogue in decrying today’s college students as unserious cell phone junkies more interested in their social media presence than in their intellectual development.

There’s a certain vogue in decrying today’s college students as unserious cell phone junkies more interested in their social media presence than in their intellectual development.

That is, so far as I can tell, mostly delusional. They are different than I was as a college student, but their world is different. If they hadn’t adapted, they couldn’t survive it. They are certainly constantly connected, for good and ill. For the good, they leave no one behind. When I went to college, my ties with high school friends mostly withered, and I became a creature of Pitt (the college) rather than Wilkinsburg (the high school). Them not so much. They seem to maintain vibrant ties across communities and chapters of their lives.

For the ill, the technology that we pressed upon them has made them less inclined to linear thought. The web was created by Tim Berners-Lee, who was trying to craft an environment hospitable to those – like him – who tended toward ADHD. The old joke is that he created an environment for those with ADHD and then trained us all to be ADHD.

They are a remarkable bunch. Ayo, whose college education was ended by the collapse of his uncle’s business but who worked to the last day to do his best work. David, who spent 29 years in prison for a crime he was exonerated of and who aspires to be a counseling psychologist. T.Y., whose brother was murdered mid-term and who returned after an absence of just four days with renewed determination to succeed. The Film Cluster, three students who were sharing a film and theatre major and nearly bubbled over at the start of each class. Sean, who began to speak about his WAsian – white Asian – identity and his crazy family. Genevieve, whose mind grew like a weed. And many who wondered whether the world they were inheriting would remain hospitable.

They’re good kids. We just sent some your way. It will take them a bit to find their footing, but they will work … and work to craft a better home for us all. Rejoice.

In this month’s Observer

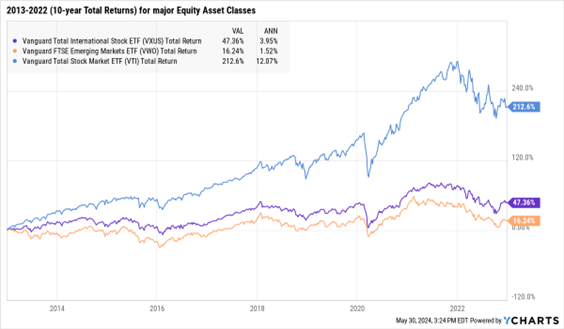

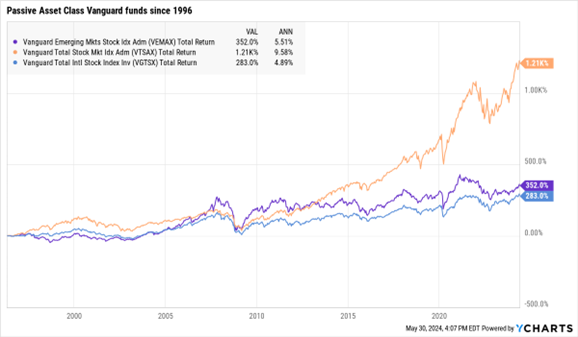

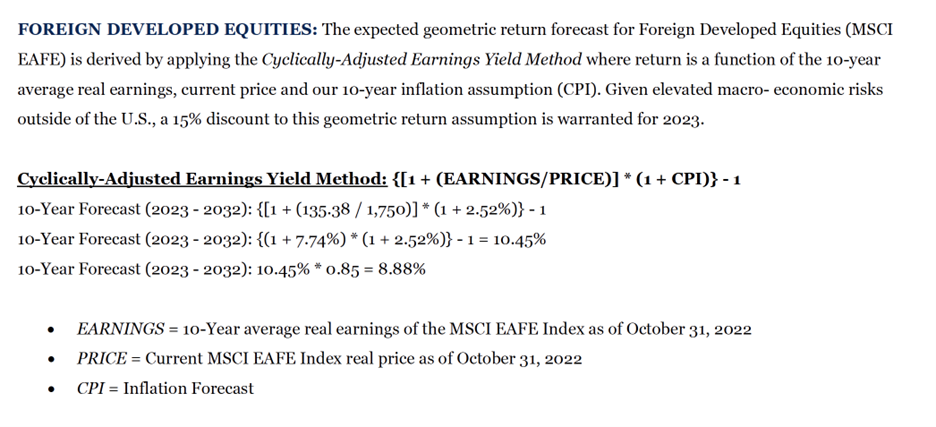

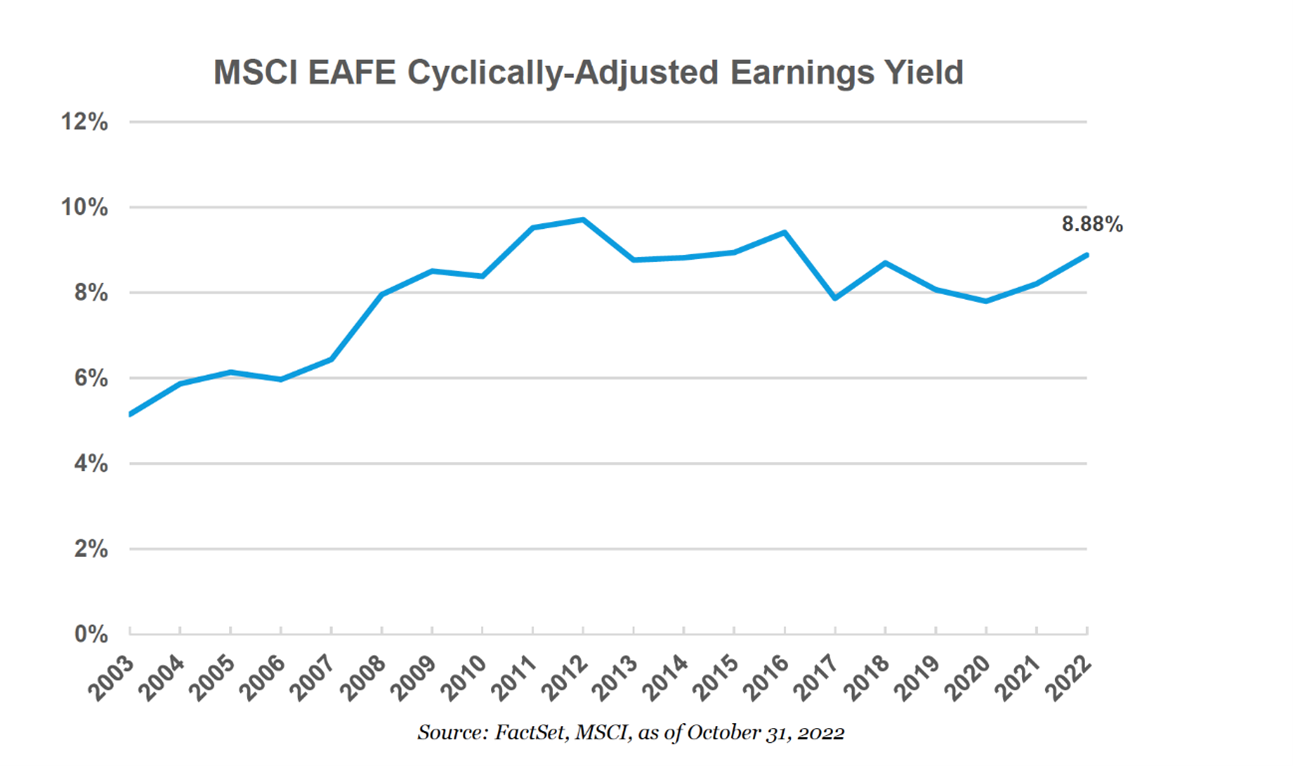

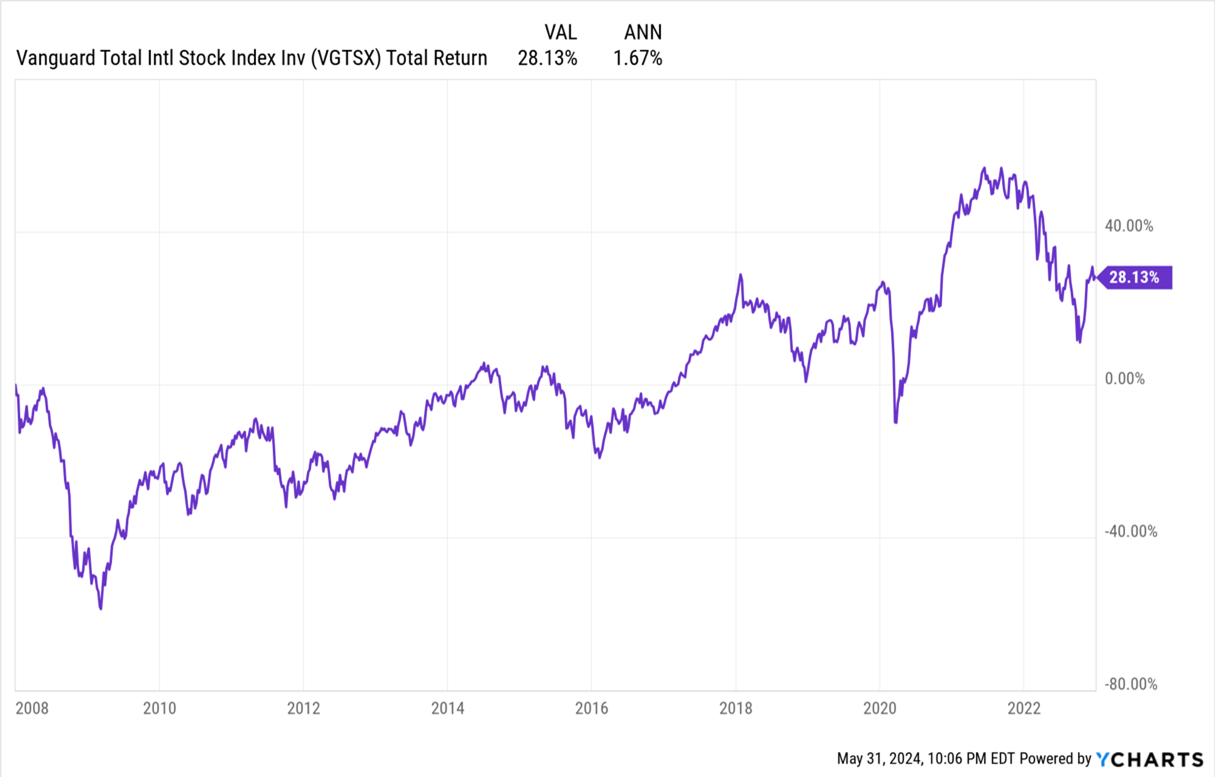

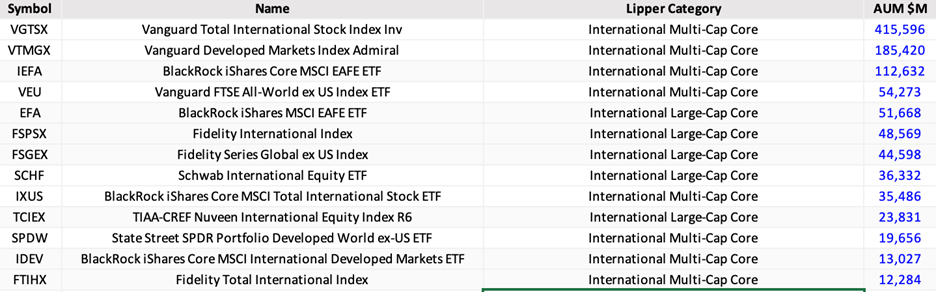

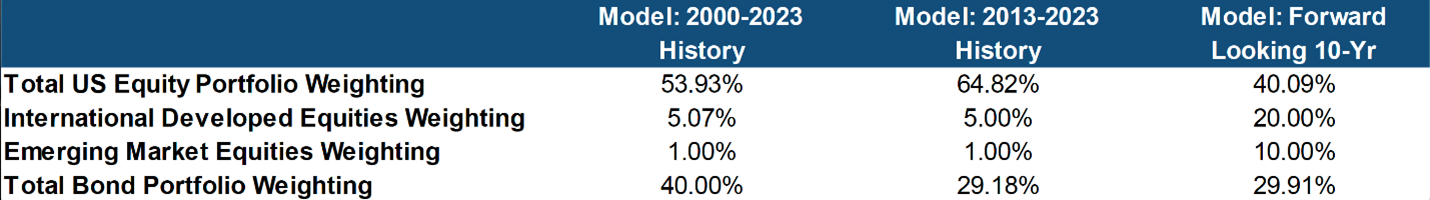

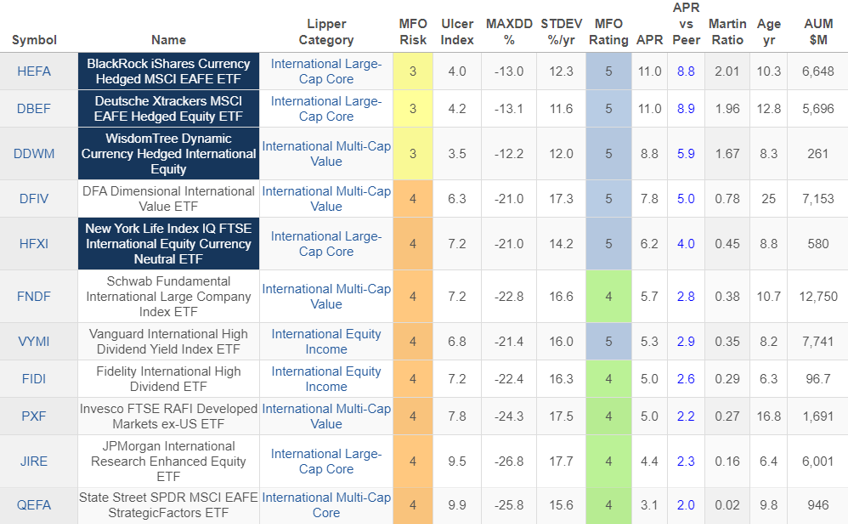

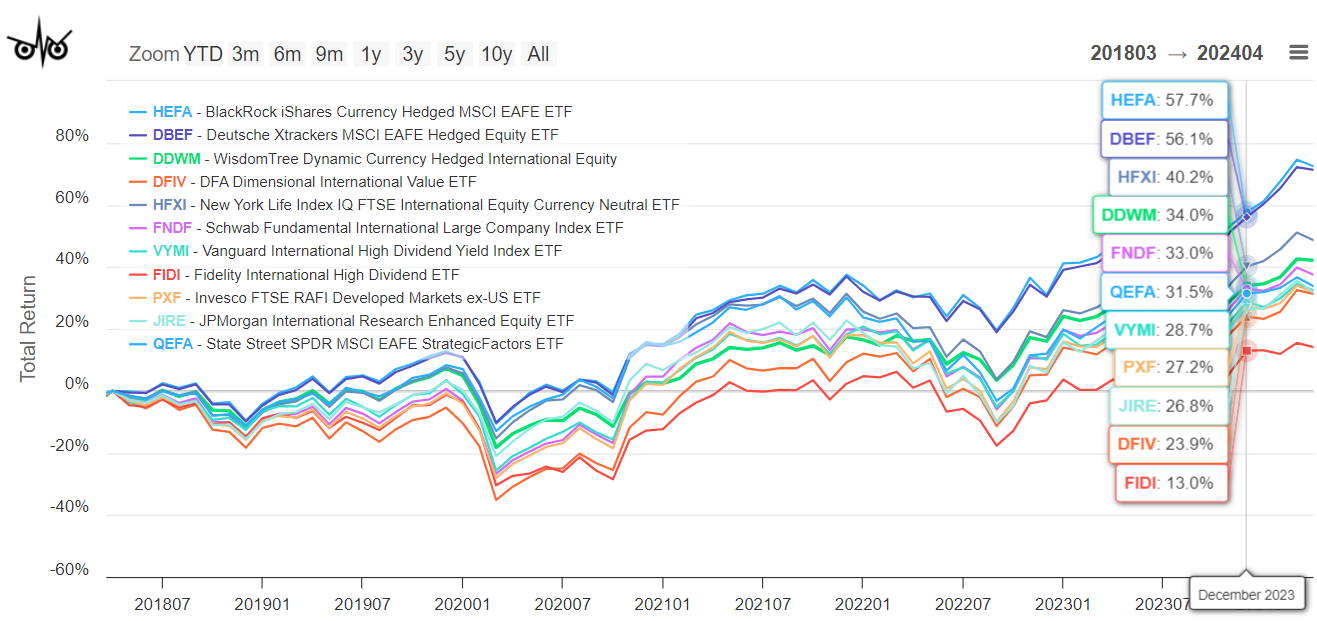

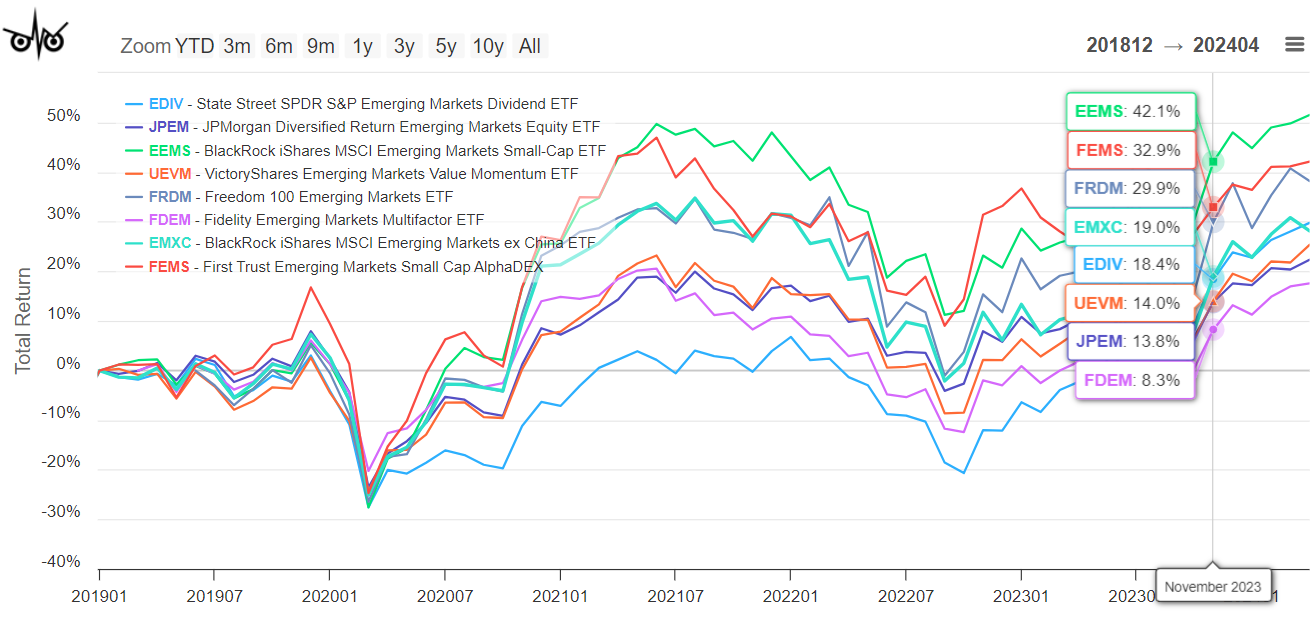

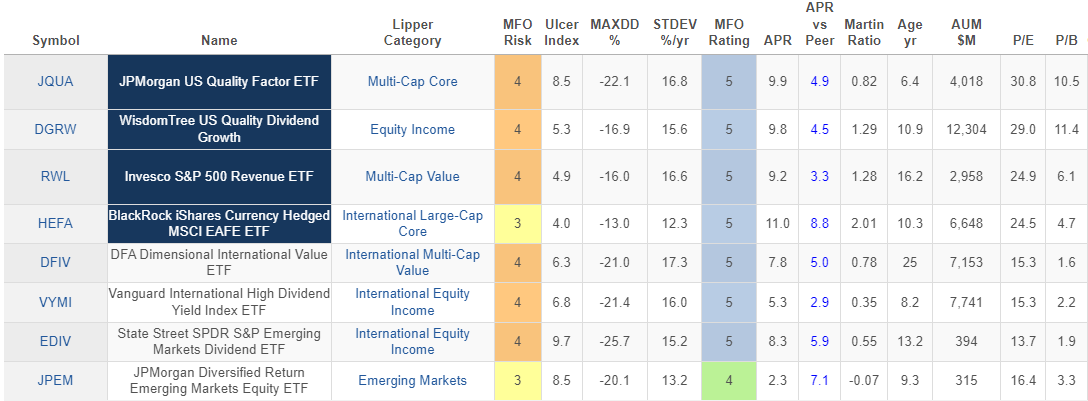

We begin summer with a really exceptional, thoughtful analysis by Devesh Shah on how to think about allocating assets to international equities. The conventional wisdom, driven by Yale’s former CIO, is to start with 18% international. Devesh looks at why that’s been a multi-decade loser and offers evidence for an efficient frontier portfolio with about 5% international equity.

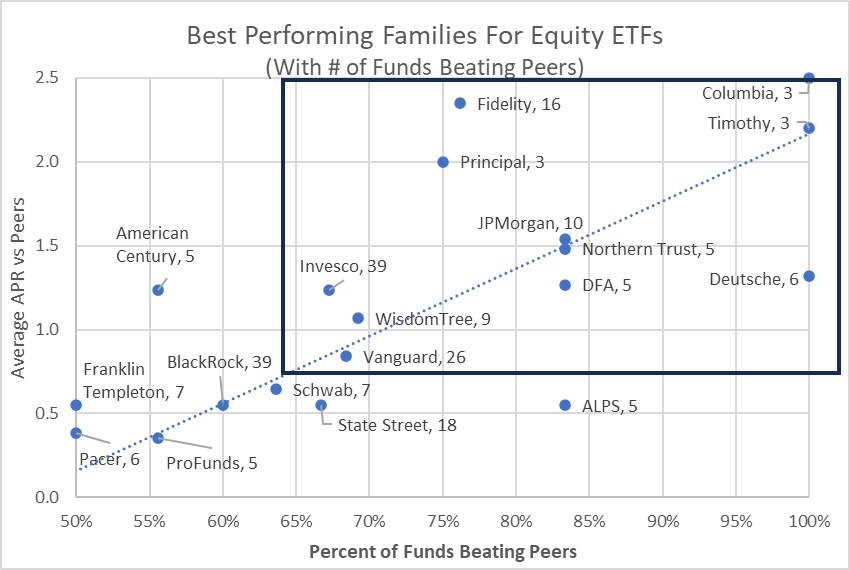

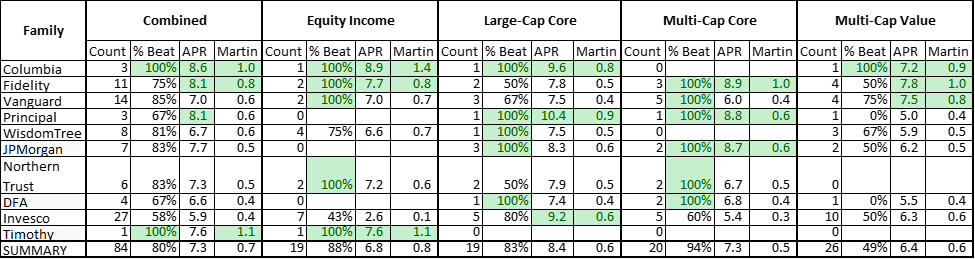

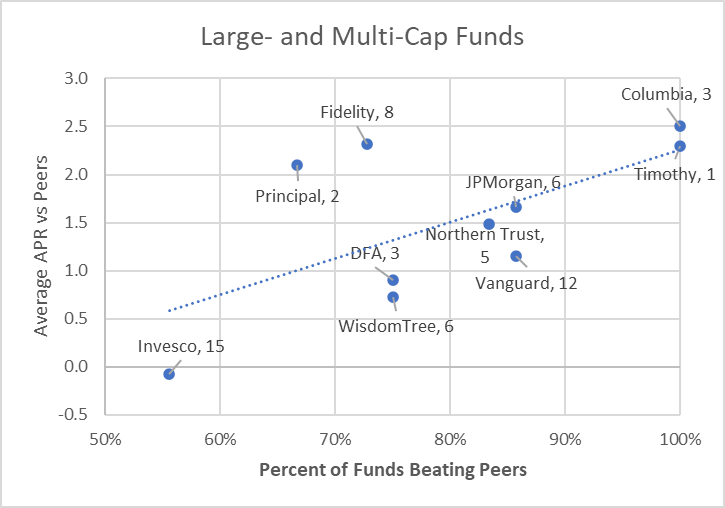

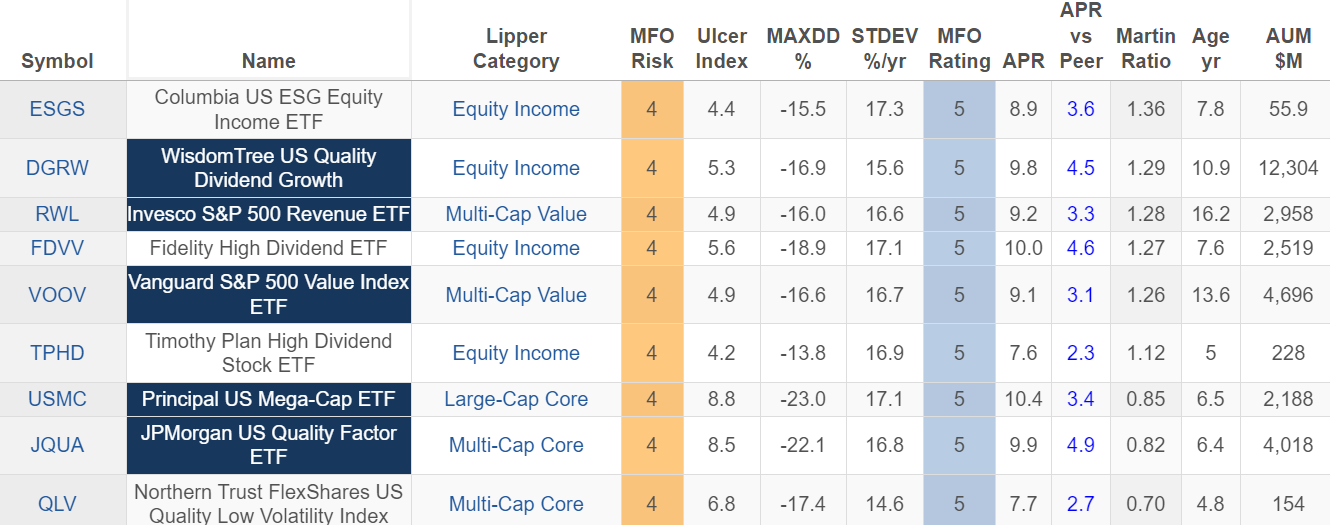

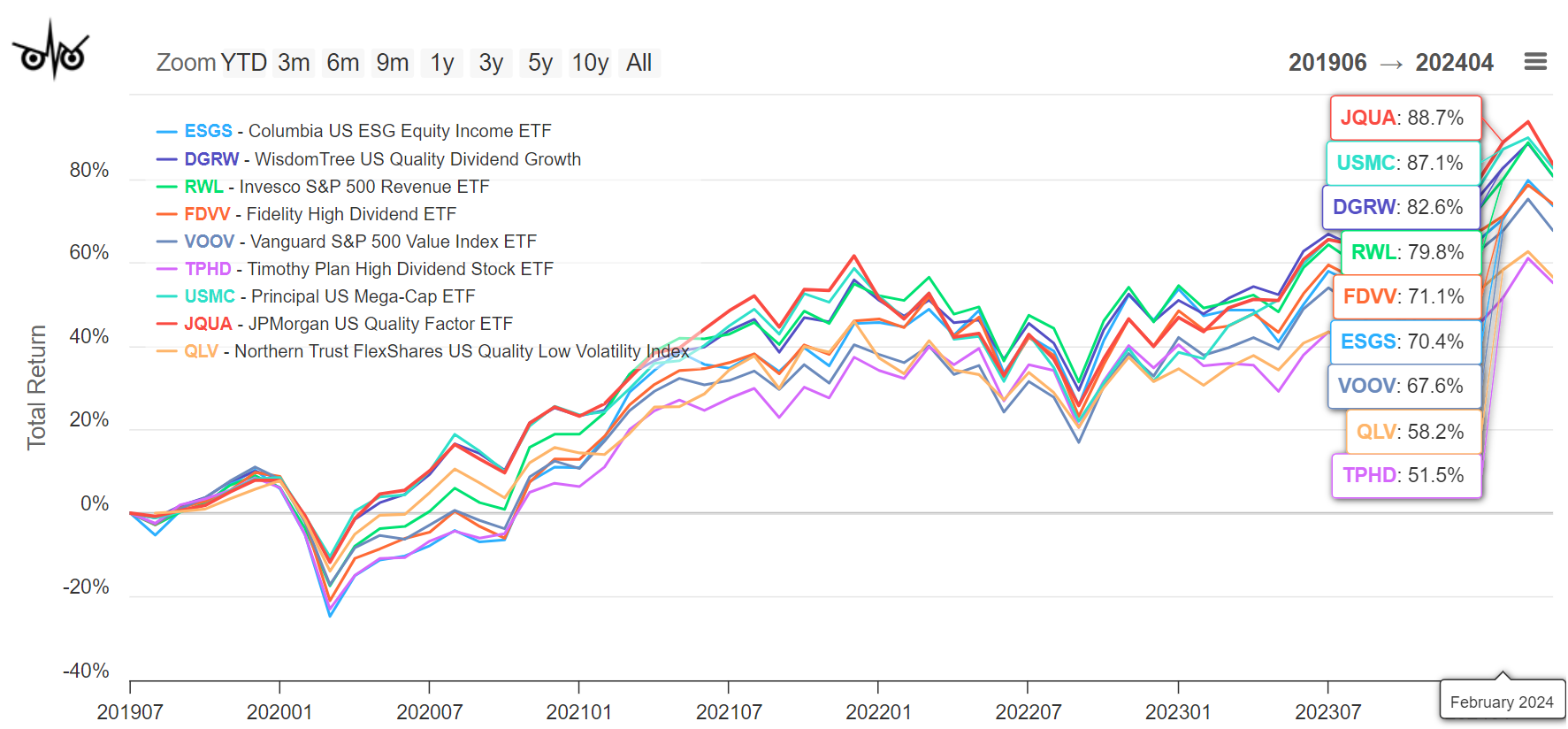

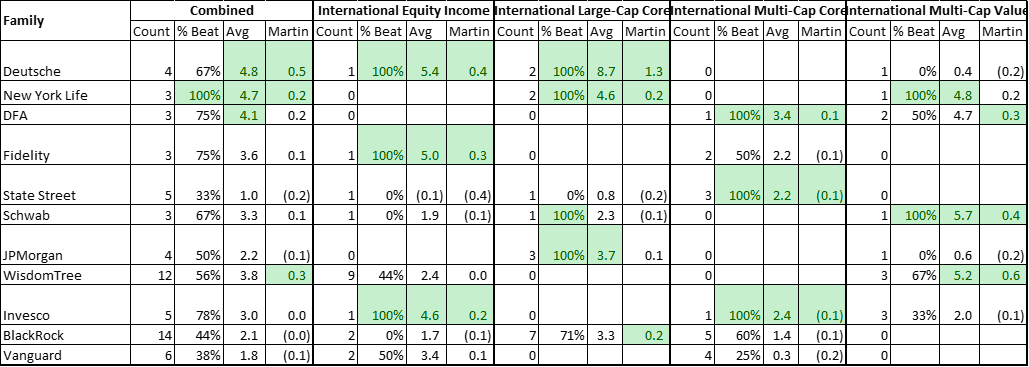

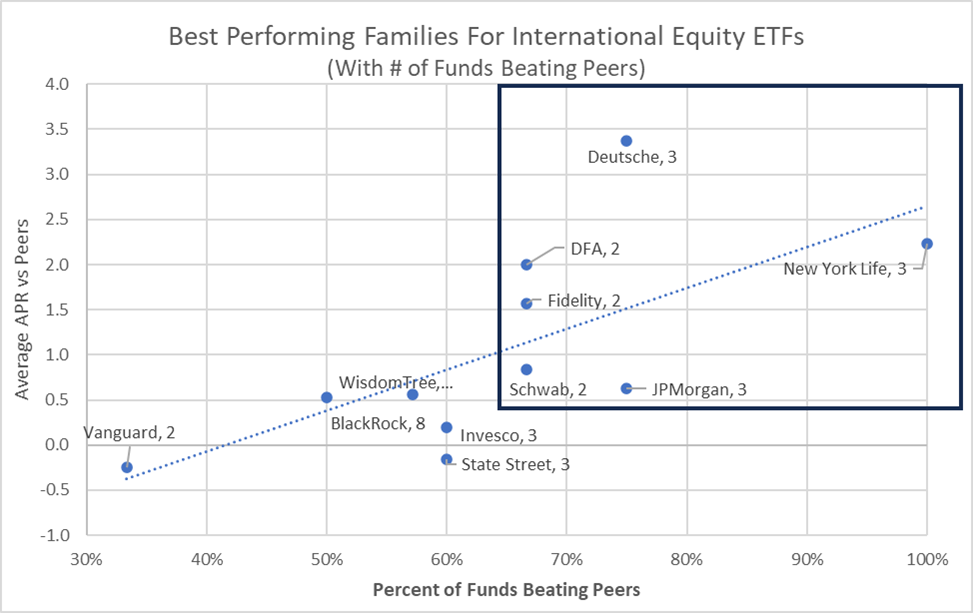

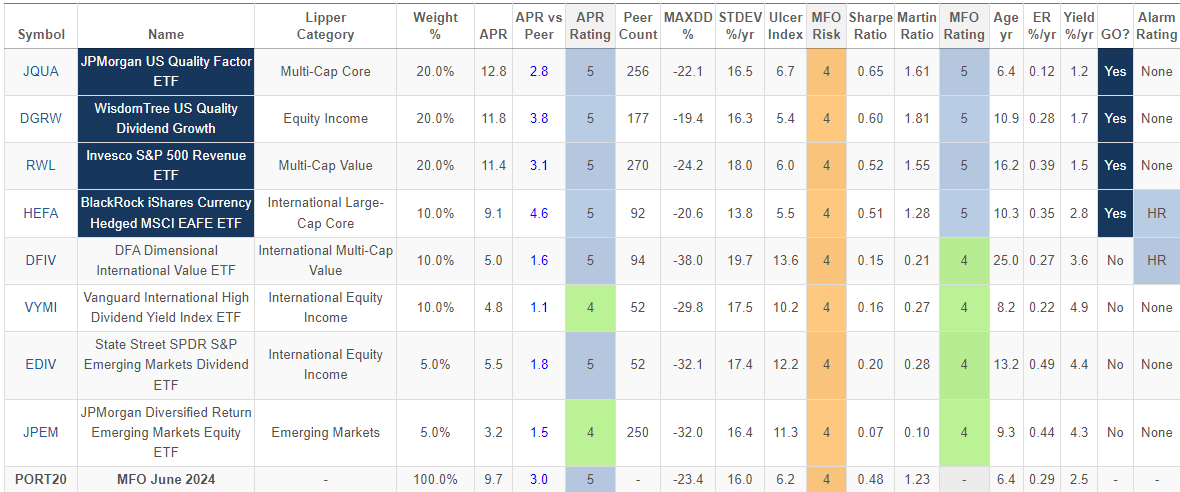

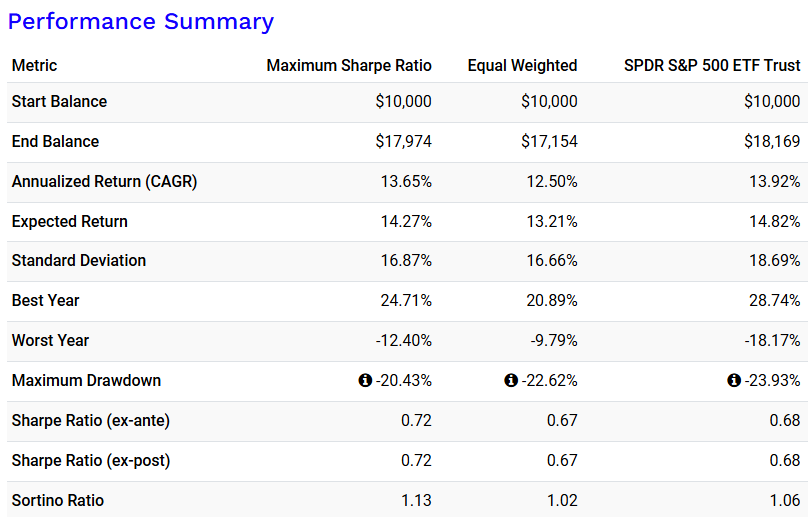

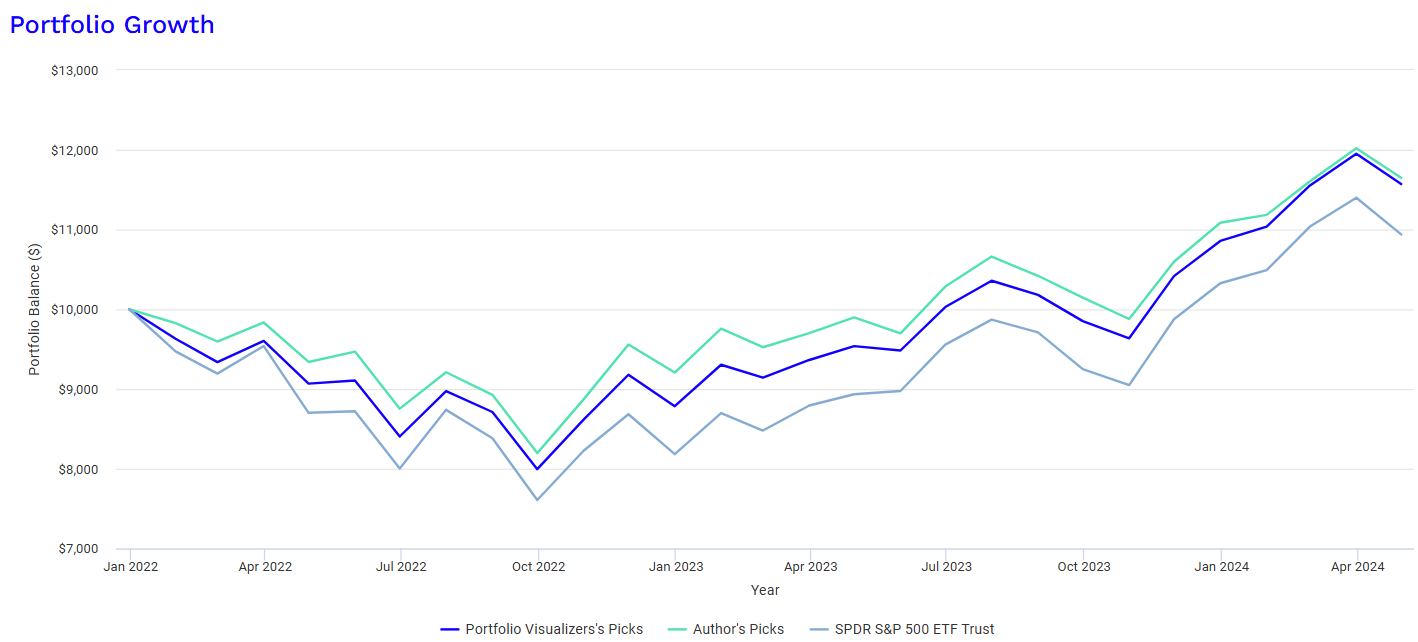

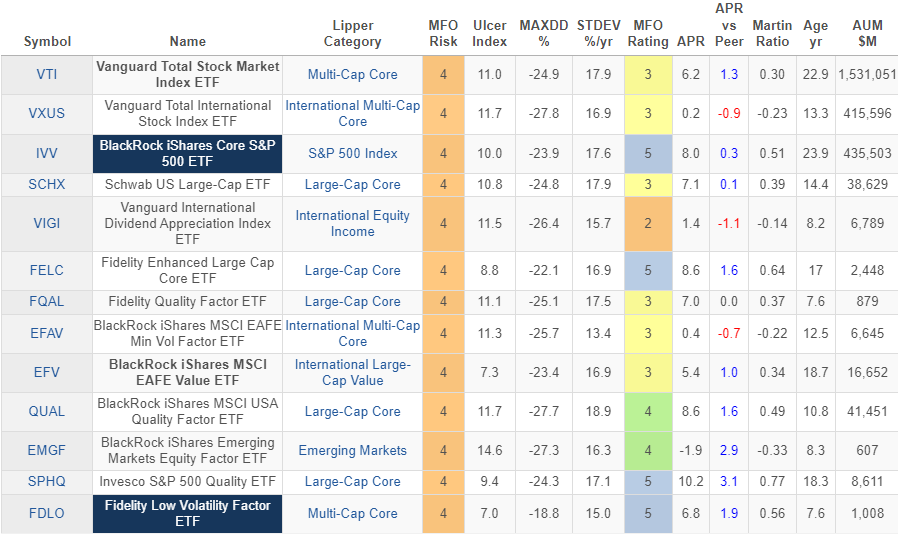

Lynn Bolin likewise embraces the data to identify the best fund families for equity ETFs. He combines the resources of the MFO Premium fund screener and the Portfolio Visualizer analysis to determine the firms that most consistently get it right and then looks at the implications in both a model portfolio and in his own.

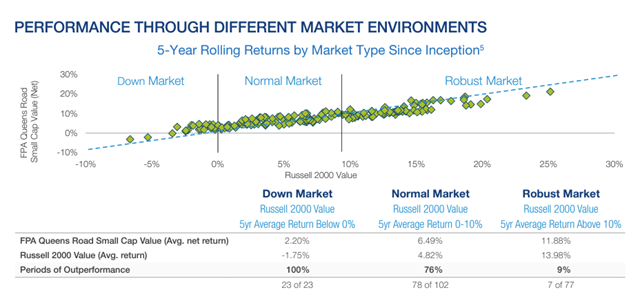

As you’ll read below, I spent a bit more than a day with the FPA managers at the FPA Investor Day in Chicago. It renewed my admiration for Steve Scruggs, his team at Bragg Financial, and the performance of his FPA Queens Road Small Cap Value Fund. The short version is brilliant protection when you need it most, solid upside the rest of the time, and some thoughtful evolution of the investment discipline, and so we’ve published an updated profile of the fund.

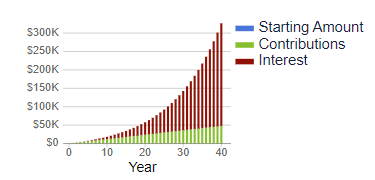

In commemoration of Augustana’s newest corps of graduates, the 164th in our history, I offer unsought words of advice for young people who need to be thinking about the role of money in their futures. Here’s the short version: money is not your ruler, it’s your servant, and here’s how to set the foundation of a long and healthy relationship with it.

Finally, The Shadow has been doing faithful sleuthing on the industry … and on the MFO Discussion board. He commends two thoughtful discussion threads – on commentaries by the managers of GMO US Quality Equity ETF and Palm Valley Capital Fund – to your attention and also shares the industry’s churning as funds become ETFS or … well, corpses.

FPA Investor Day: Minds in Motion

It’s no secret that most active managers are nice people who simply don’t earn their keep. MFO’s founding principle is that 80% of funds could be shuttered immediately with no loss to anyone but their advisers. There are some arenas where their odds are somewhat better – emerging markets, developed international equities – but those are few.

MFO’s mission is to connect thoughtful individual investors with the small cadre of thoughtful professional investors whose skills might materially increase your chance of success. What is “success”? Our mantra is simple: success is when the sum of your resources exceeds the sum of your needs at the moment you need them. It’s not about investing as a game; if your portfolio beats the market ten years out of 10 and your resources are less than the sum of your needs, you’ve lost. If your portfolio never beats “the market,” but at the finish line, you have the resources you need to live the life you’ve worked for, you’ve won.

What characterizes the 20% of managers who are actually worth your attention? They keep it simple so you can understand what’s happening to the money you entrust to them. They loathe the idea of losing your money. They have managed successfully across time and market cycles. They invest beside you (the research is great: having the manager invested improves risk-return performance a bit, having the trustees – the manager’s bosses – invested improves it a lot, and having their mother-in-law in the fund … golden!), they communicate openly with you, and they are accessible to you (it’s called a “telephone,” and only some advisers appear to own one). And, finally, they are still learning. The phrase is “ancora imparo.” In Latin, it’s attributed to Michelangelo at age 87 and translates as “I am still learning.”

That often leads us toward the near-extinct tribe of absolute value investors, guys who have an instinctive aversion to the excuse, “Well, it’s the best of a bad lot.”

On May 21-22, FPA hosted their Investor Day in Chicago, Illinois. I was pleased to be able to attend.

FPA is a Los Angeles-based adviser managing about $26 billion in assets. Their mission statement is “We aim to be recognized as a leading practitioner of value investing. We seek to offer our clients a prudent place to invest their capital, and to provide them with market-beating returns over the long term while emphasizing preservation of capital. We also seek to foster a culture of excellence, to maintain high ethical standards, and to adhere to our Core Values.” They advise five FPA funds (three open-ended, one close-ended, and one ETF) and, through a strategic partnership with North Carolina’s Bragg Financial, the two FPA Queens Road funds.

FPA is a Los Angeles-based adviser managing about $26 billion in assets. Their mission statement is “We aim to be recognized as a leading practitioner of value investing. We seek to offer our clients a prudent place to invest their capital, and to provide them with market-beating returns over the long term while emphasizing preservation of capital. We also seek to foster a culture of excellence, to maintain high ethical standards, and to adhere to our Core Values.” They advise five FPA funds (three open-ended, one close-ended, and one ETF) and, through a strategic partnership with North Carolina’s Bragg Financial, the two FPA Queens Road funds.

| Portfolio Managers | Ratings | Manager Ownership | |

| FPA Crescent Fund (FPACX) | Steven Romick Mark Landecker Brian A. Selmo | Five star Silver MFO Honor Roll LipperLeader for Total Return and Consistent Return |

Over $1,000,000 Over $1,000,000 Over $1,000,000 |

| Source Capital (SOR) | Steven Romick Mark Landecker Brian A. Selmo Abhijeet Patwardhan | Four-star LipperLeader for Total Return and Consistent Return |

Over $1,000,000 $100,000-$500,000 $100,000-$500,000 $10,000-$50,000 |

| FPA Flexible Fixed Income Fund (FPFIX) | Abhijeet Patwardhan | Four-star Bronze MFO Great Owl LipperLeader for Total Return and Consistent Return |

Over $1,000,000 |

| FPA New Income Fund (FPNIX) | Abhijeet Patwardhan | Four star Bronze LipperLeader for Total Return and Consistent Return |

Over $1,000,000 |

| FPA Queens Road Small Cap Value Fund (QRSVX) | Steven H. Scruggs | Five star Gold LipperLeader for Total Return and Consistent Return |

Over $1,000,000 |

| FPA Queens Road Cap Value Fund (QRVLX) | Steven H. Scruggs | Five star Gold LipperLeader for Total Return and Consistent Return |

Over $1,000,000 |

We had a chance to listen to, question, and dine with each of their teams.

Highlights thereof:

the folks at FPA are (1) good and (2) still learning.

Each manager began by explaining what they do and continued on to explain how what they do is evolving. The former is richly explained in our profiles of the funds and on the FPA website, so I’ll just say a few words about the latter.

Steve Romick and Brian Selmo, representing FPA Crescent and Source Capital, their closed-end fund:

Crescent launched in 1993 and became an FPA fund in 1996. It has a famously flexible portfolio with an absolute return focus and the ability to invest across capital structures, geographies, sectors, and market caps. Source launched in 1968 and was adopted by the FPA Crescent team at the start of 2016. Over the past one-, three- and five-year periods, the correlation between the funds is between 98-99.

- The most pronounced change over the past 10-15 years has been a reversal of the fund’s exposure to quality stocks versus special opportunities (aka distressed securities). Currently, the fund is about 70% high-quality equity and 30% special opps; it used to be reversed.

- The fund works hard to avoid investing in disrupted companies but tends not to pursue their disruptors either.

- Volatility has been helpful as speculators with no attention span (by their estimate, 20-30% of all stock trades are in reaction to quarter earnings calls) sell to investors with long-term ones. Mr. Romick referred to the time-arbitrage advantage as people with 90-day perspectives sell to people with five-year ones.

- Inflation is likely to be higher over the next 10-20 years than has been experienced in the past 10-20 years. If that holds true, the fund will likely have greater equity exposure than it traditionally has. Higher inflation makes cash a losing proposition and it’s rarely a friend of fixed income, so equities will default to a higher weighting.

By way of full disclosure, Crescent is my largest non-retirement holding. I first invested in it near the turn of the century and added to it recently.

Abhijeet Patwardhan, representing FPA New Income, a risk-averse fund investing in short-term investment grade and high-yield debt, and FPA Flexible Income, an institutional fund with more duration flexibility:

- Patwardhan is Fed agnostic. He does not know what the Fed will do and can’t guess right often enough to justify the effort.

- Bonds have an asymmetric risk-return profile: they have zero upside (hold them to maturity, and you get exactly what you paid for) but unlimited downside (i.e., default). As a result, there’s a strong focus on downside management.

- The high-yield market is not currently worth the effort.

- Contrarily, they are being paid to move out of the maturity spectrum a bit. In 2021, the fund had a duration of 1.4 years; that’s now climbed to 3.04 years.

Steve Scruggs, representing FPA Queens Road Small Cap Value Fund, the archetype of a quality-at-a-reasonable price portfolio:

- As with Crescent, the attractiveness of cash has been diminished. Mr. Scruggs ran an analysis of the impact of cash on the portfolio. His finding was the security selection produced about two-thirds of the fund’s downside protection. In consequence, he expects to dial back the fund’s cash holdings with an effective cap of about 10% cash. As recently as 2020, they sat at about 23% cash.

- He’s focusing on companies with pricing power in anticipation of an extended stretch of higher inflation.

- He suspects that artificial intelligence might have the same magnitude of impact as did the internet. While he’s certainly not ever going to dash in the direction of the current equivalent of a dot.com darling, he is actively assessing the ways in which AI will impact – for good and ill – the prospects of portfolio companies.

- The small cap universe is seeing some of its lowest valuations since the days of the dot.com bubble. That said, many small caps are trash, and high-quality small caps available at reasonable prices are harder to find. He’s willing to pay a bit of a price premium for great companies but is more demanding on the valuations of merely quite good ones.

On the whole, I came away with a sense of continuity and change. The firm’s commitment to quality, to risk management, and to standing with their investors has not changed at all. Their understanding of the changed economic and technological environment has led them to make thoughtful, incremental changes to the process of portfolio constructs.

The process and the results both are encouraging.

The climate

The most common story surrounding the global climate can be summarized in two words:

We’re.

Screwed.

Collectively, we’re also in a curious denial. Two-thirds of the American public agrees that things are going from bad to worse, and then we rush out to buy another living room on wheels. Light trucks, including pickups and SUVs, are now around 80% of all “car” sales. Good for manufacturers (the profit margin on SUVs is about five times as great as on cars), bad for drivers (they’re expensive and have a habit of getting into accidents because they’ve about as easy to maneuver as the Queen Mary), and terrible for the planet (ummm … my sister’s mid-sized SUV clocks in at 15.5 mpg).

In case you’re wondering about the “living room on wheels” sobriquet, here’s a quick look at the 50-year evolution of pickup trucks from utilitarian job site haulers to … well …

It is worth remembering, however, that a lot of people are working to change our fate. From government incentives to encourage renewables and conservation (the Inflation Reduction Act is creating a surprising surge in the deficit precisely because so many businesses, farmers, and homeowners are finding its incentives compelling) to smart scientists and businessfolks who are finding ways to do more with less (carbon), there have been some incredibly positive changes.

It is worth remembering, however, that a lot of people are working to change our fate. From government incentives to encourage renewables and conservation (the Inflation Reduction Act is creating a surprising surge in the deficit precisely because so many businesses, farmers, and homeowners are finding its incentives compelling) to smart scientists and businessfolks who are finding ways to do more with less (carbon), there have been some incredibly positive changes.

At one level, our carbon emissions may already have passed their peak levels. The New York Times “Climate Forward” newsletter:

Amid a deluge of terrifying headlines about destructive tornadoes, blistering heat waves, and DVD-sized gorilla hail, here’s a surprising bit of good news: Global carbon dioxide emissions may have peaked last year, according to a new projection.

It’s worth dwelling on the significance of what could be a remarkable inflection point.

For centuries, the burning of coal, oil and gas has produced huge volumes of planet-warming gasses. As a result, global temperatures rose by an average of 1.5 degrees Celsius higher than at the dawn of the industrial age, and extreme weather is becoming more frequent.

But, we now appear to be living through the precise moment when the emissions that are responsible for climate change are starting to fall, according to new data by BloombergNEF, a research firm. This projection is roughly in line with other estimates, including a recent report from Climate Analytics. (“Climate: The right kind of tipping point,” 5/30/2024)

At a more micro-level, several manufacturing changes have emerged that might revolutionize two industries, solar and steel. (Yes, steel.)

The Wall Street Journal reports that a well-funded company has a process for substantially reducing the price of producing solar cells, allowing US manufacturers to compete with half-price Chinese cells.

Steel production, in which iron ore is heated with coal to produce iron oxide, accounts for 8% of the world’s greenhouse gas production. Boston Steel, a US-based start-up, has received $300 million in funding to commercialize its process for producing carbon-free steel.

That doesn’t make it all better. Far from it. But it does remind us of a simple point: things can get better if we’re willing to work together. It will require a temporary end to our recent fixations with conspiracies and circuses in favor of conscious action, but our fate remains in our own hands.

Morningstar on tap

Both Charles Boccadoro, maestro of MFO Premium, and I will be bouncing around the Morningstar Investment Conference in late June. Feel free to reach out to Charles or me if you’d like a chance to chat during the newly abbreviated gathering.

Thanks, as ever …

To the folks who reached out to celebrate the wedding of Chip and me. Thanks especially to The Grinch (a pseudonym, I suspect) for a celebratory donation to MFO and, for the beautiful flowers, to Dick who, like me, has spent much of his adult life in academe.

To the folks who reached out to celebrate the wedding of Chip and me. Thanks especially to The Grinch (a pseudonym, I suspect) for a celebratory donation to MFO and, for the beautiful flowers, to Dick who, like me, has spent much of his adult life in academe.

To Sharon, whose matched contribution made the FPA Investor Day trip way more manageable … and to the FPA folks for being such exemplary hosts.

To Matthew from Bellevue, Russell of WI, Kevin, and Mark. Gracias!

And to our faithful regulars, Wilson, S&F Investment Advisors, Gregory, William, William, Stephen, Brian, David, and Doug, míle buíochas!